child tax credit portal update dependents

Since on your 2020 tax return. That total changes to 3000 for each child ages six through 17.

Advance Child Tax Credit Payments In 2021 Internal Revenue Service

The enhanced CTC during the pandemic was 3600 for children under 6 and 3000 for children 6 and up.

. The full monthly child tax credit benefit is eligible for incomes up to 75000 for individuals 112500 for heads of household and 150000 for married couples. Child tax credit portal update dependents Tuesday March 29 2022 To complete your 2021 tax return use the information in your online account. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300 monthly payments this year.

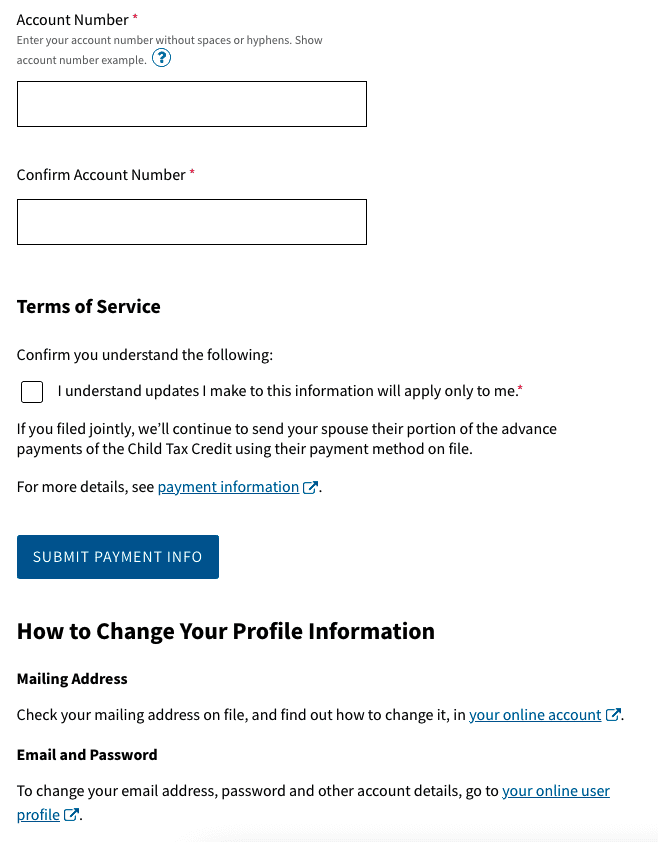

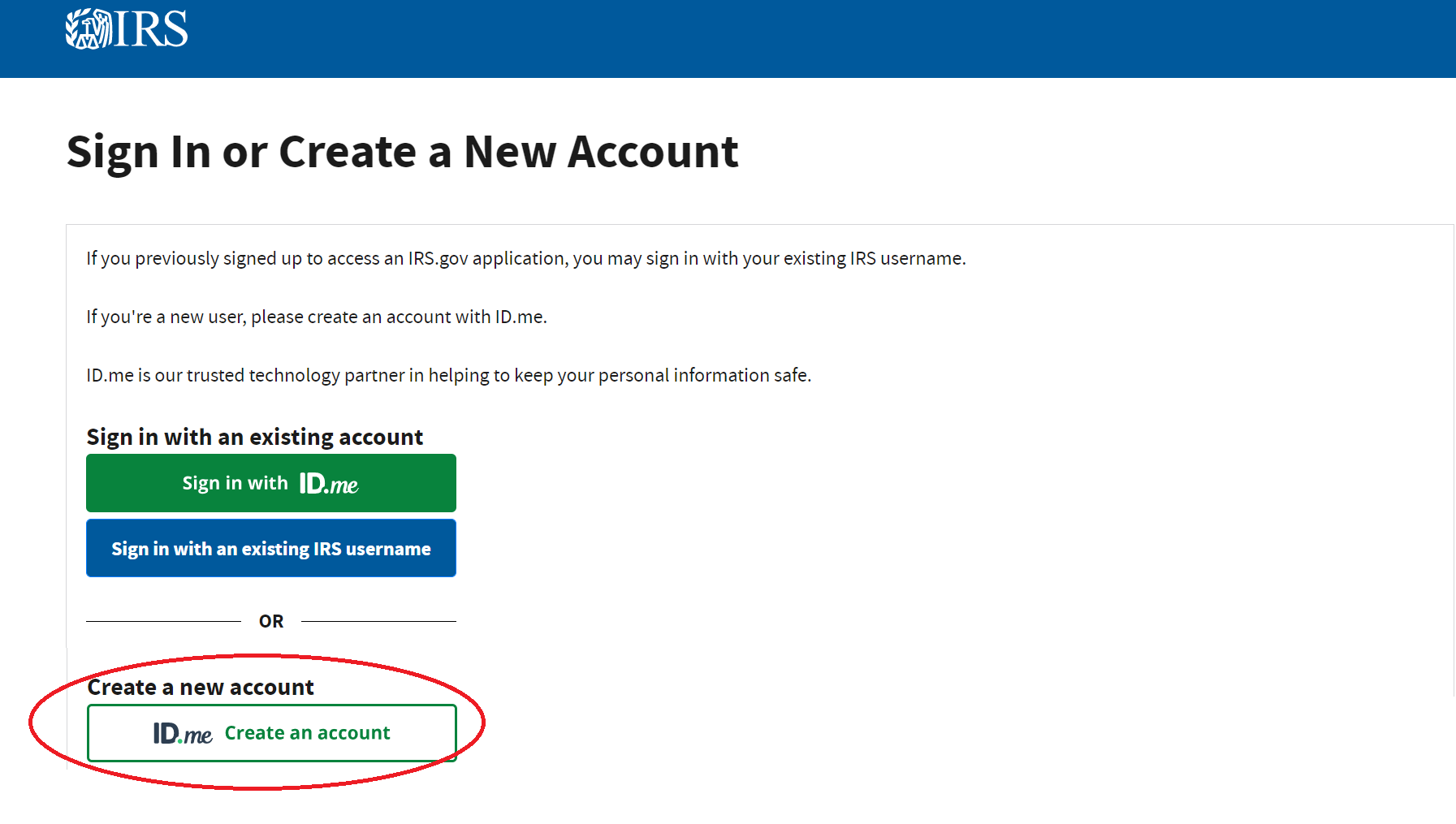

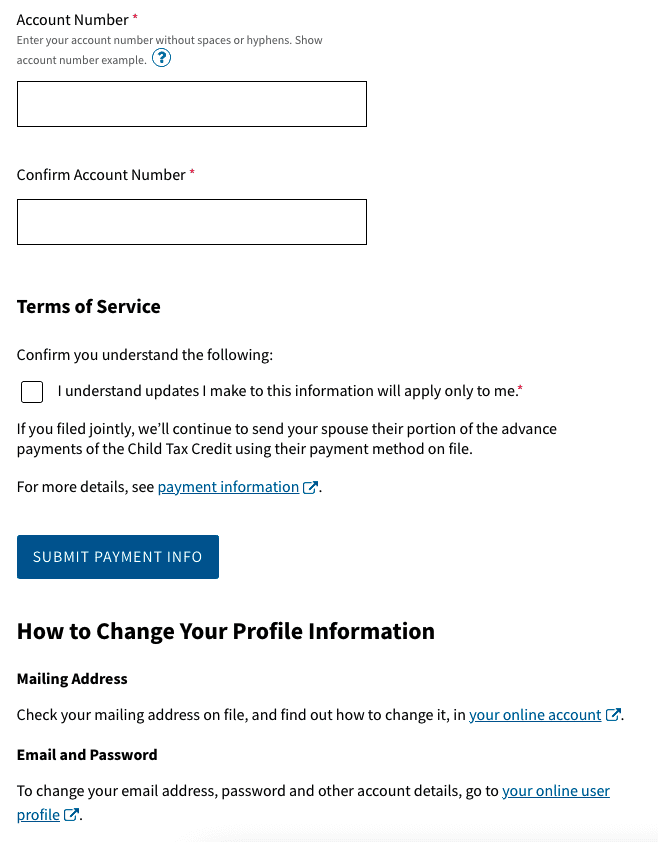

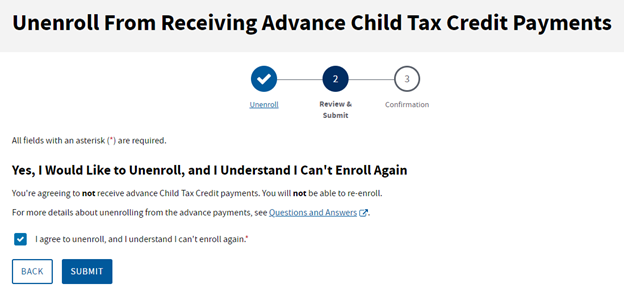

The monthly child tax credit payments will begin on July 15 Credit. The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child. To qualify for the credit the dependent must not file a joint return.

Here is some important information to understand about this years Child Tax Credit. Getty Parents can also receive a 3600 credit for children under six years old. For each kid between the ages of 6 and 17 up to.

The Child Tax Credit provides money to support American families. The IRS will make a one-time payment of 500 for dependents age 18 or fulltime college students up through age. Biden has also altered the way.

The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit. W ith just one Child Tax Credit remaining for 2021 United States citizens have until November 29 to make any final changes in their IRS portal relating to their income before their. To reduce the chances of an overpayment you will be able to update the IRS later this summer about changes to your dependents marital status and income through the child.

Hey everyone I just want to make sure Im not crazy and that we are indeed still waiting for the IRS portal to update so that we can make changes to our dependentsmarital statusincome. Hence the next deadline for those interested is October 7 by 2100 PT or 0000 ET. To deregister you should visit the Child Tax Credit Update Portal and choose the Manage.

2021 Child Tax Credit How To Claim It And File 2021 Taxes

Child Tax Credit New Update Address Feature Available With Irs Online Portal Youtube

Not Everyone Received Child Tax Credit Payments About Saverlife

You Got Your Last 2021 Advance Child Tax Credit Payment Now What Don T Mess With Taxes

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

Child Tax Credit Payments What S Next

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Dependent Children 2021 Tax Credit Jnba Financial Advisors

2021 Child Tax Credit How To Claim It And File 2021 Taxes

Child Tax Credit Update Irs Launches Two Online Portals

How You Can Claim Up To 16k In Tax Credits For Child Care In 2021 What To Do First Mlive Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The Child Tax Credit The White House

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What Families Need To Know About The Ctc In 2022 Clasp

Get Caught Up Clearing Up Confusion Surrounding Changes To Child Tax Credit

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet